This article focuses on how to purchase physical precious metals – either online or from a local coin shop. At Ultimate Wealth Ideas, we recommend including silver and gold as part of your portfolio. With prices within 10-20% of their lowest levels in years, now is the perfect time to make a purchase.

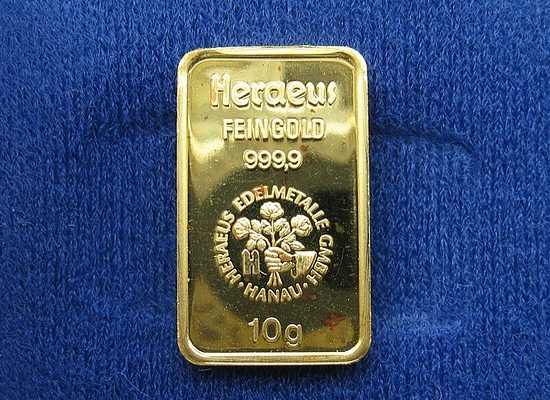

Before we begin to talk about the online stores, let’s start with the local coin shops. In your local area it is possible to purchase physical metal from many different places. Some of these may include flea markets, We Buy Gold stores, pawn shops, and some pure coin shops. At ultimate wealth ideas, we suggest sticking with the pure coin shops when buying from your local market. The prices may be a little higher from purchasing at a local coin shop rather than purchasing online, but you get delivery immediately. Another benefit of purchasing from a local coin shop is that you can pay with cash. In the local area alone there are a handful of places that sell physical gold and silver to customers. If you are purchasing large denomination bars it is often times tough to find them at the local coin shops. On the other hand, we almost always see 1-ounce gold coins or smaller available for purchase. As for silver, there is usually junk silver that is available for purchase. Junk silver is pre-1964 quarters, dimes, and half dollars. The premiums for Junk silver are often times higher than the premiums for generic 1-ounce rounds. This is due to the fact that junk silver is in limited supply as there is no way for any more to be made. Occasionally you will find 10-ounce or 100-ounce bar available at the local coin shop and the premiums for these are much smaller than 1-ounce coins. Most coin shops will have American Eagles but these command the highest premium of all coins. On occasion you can find Canadian Maples, Chinese pandas, or Austrian Philharmonics, but one must purchase over $500 worth of these foreign coins in order to not pay the tax.

With many brick-and-mortar stores going by the Wayside, the ability to purchase physical precious metals online has exploded over the past few years. There are so many options to choose from and it is important to sort through the options in order to get the best deals available on the internet. Delivery of the physical metals is critical in this day and age. There have been many online stores that have been shut down due to not being able to deliver the physical products to their customers. If you want to purchase online just like you would through Amazon or through any other online retailer we suggest three stores for this. Our favorite pick is Texas Precious Metals – www.texmetals.com – as they seem to be the quickest to get the metal into your hands. Their selection may not be as good as APMEX or Provident Metals but they often times have the best deals and the best customer service. They have their own 10 ounce silver bars and 1-ounce silver rounds that they sell at extremely low premiums which are very enticing for investors. They have a silver coin that is .9999 pure, which is the same as the Canadian Maple Leaf, while the US American Eagle is only .999 pure. They always have large and small denominations of gold coins and bars and a plethora of 1-ounce coins and bars, 10 ounce bars, and 100 ounce bars. Provident Metals – www.providentmetals.com – has a great selection and often times offer free shipping to their orders. In addition to the selection mentioned above for Texas Precious Metals, Provident Metals has an incredible selection of foreign coins, rare coins, and numismatics. APMEX – www.apmex.com – is the world’s largest online retailer of silver and gold. They have done over $6.5 billion in transactions since 1999. If you are looking to purchase other precious (palladium or platinum), we definitely suggest checking out APMEX.

The average premium (the price above the current market price for delivery of a commodity) for silver coins average somewhere between 10 – 20% whereas bars are usually somewhere between 3 – 7%. When selling the coins back, the bars are purchased at a discount from the spot price (which is the price the commodity currently trades at on the open market), where coins (especially American Eagles, Canadian Maples, Chinese Pandas, an Austrian Philharmonic) are purchased back at the spot price or above in many cases. Some precious metals advocates advise to purchase the most silver at the lowest premium, while others advocate purchasing name brand bars and coins as they command the higher price when selling. At Ultimate Wealth Ideas, we suggest a mixture of name brand coins and bars of gold and silver. If you have any questions, about making a purchase of physical precious metals, please email us at info@ultimatewealthideas.com.